Cash vs Accrual Accounting: Differences Explained

Category : Bookkeeping

As a refresher, in cash basis accounting, income is recorded when you receive it. One important thing to note, however, is that accrual basis accounting does not give you an accurate picture of your cash flow. If you use accrual accounting, you’ll need to keep a close eye on cash flow in order to avoid potentially devastating consequences.

Which financial statements are the most affected by accounting methods?

To choose your method of accounting, you must compare your business situation to the rules for accounting stated by the IRS. If you as the business owner later want to change your accounting method, you must get IRS approval. This process can be complicated, though, so you may want to seek help from a tax professional.

In contrast, accrual basis accounting is a more complex system that records transactions when they take place, regardless 5 cash flow performance kpis every cfo needs to track of when you receive income or pay a bill. With this method, you record income as it’s received and expenses as they’re paid. Cash basis accounting only records your expenses when money leaves your account to pay suppliers, vendors, and other third parties.

Cash Basis Accounting vs. Accrual Accounting

That timing discrepancy could make it difficult for you to determine whether that job was profitable. Small businesses that need to closely track accounts receivable, inventory or major liabilities, like loans. Whichever way you choose, the accounting method you use will govern your books for a good long while—so make sure you choose wisely. If you’re searching for accounting software that’s user-friendly, full of smart features, and scales with your business, Quickbooks is a great option. To change accounting methods, you need to file Form 3115 to get approval from the IRS. Wave also offers both cash and accrual, although accrual is the default method for reporting.

Cash Vs. Accrual Accounting: What’s The Difference?

With cash-basis accounting, you won’t record financial transactions until money leaves or enters your bank account. With use accrual-basis accounting, you’ll record transactions as soon as you send an invoice or receive a bill, not when the money changes (virtual) hands. Learn the pros and cons of each bookkeeping method below and decide which one is right for you.

This also helps you analyze your income and expenses, which can provide investors with a more accurate picture of the financial health of your business. The other advantage of cash accounting is that it provides a real-time picture of your available cash. If you need to know exactly how much available cash is in your bank account at any one time, cash accounting offers an accurate tracking system. The payroll of a business involves an Accrued Payroll account, a type of accrued expense.

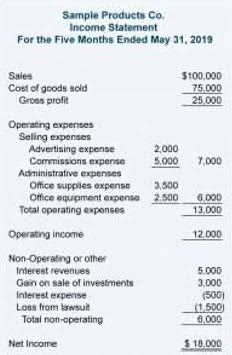

Accrual accounting is an accounting method in which payments and expenses are credited and debited when earned or incurred. Accrual accounting differs from cash basis accounting, where expenses are recorded when payment is made and revenues are recorded when cash is received. With the accrual accounting method, income and expenses are recorded when they’re billed and earned, regardless of when the money is actually received. The main difference between accrual and cash basis accounting is the timing of when revenue and expenses are recorded and recognized.

- This also helps you analyze your income and expenses, which can provide investors with a more accurate picture of the financial health of your business.

- If you need to know exactly how much available cash is in your bank account at any one time, cash accounting offers an accurate tracking system.

- Another disadvantage of the accrual method is that it can be more complicated to use since it’s necessary to account for items like unearned revenue and prepaid expenses.

- The vast majority of companies that people would potentially invest in will be using accrual-based accounting.

- Using the cash method for income taxes is popular with businesses for two main reasons.

Unlike the cash method, the accrual method records revenue when a product or service is delivered to a customer with the expectation that money will be paid in the future. Likewise, expenses for goods and services are recorded before any cash is paid out for them. Companies with revenues of less than $26 million over 3 years and who aren’t corporations or partnership corporations have the option to use cash basis accounting. They may choose to use the cash basis method because it’s more straightforward, making it a good fit for business owners who don’t want to bring in additional accounting support. Cash basis accounting is a straightforward method that records transactions at the time that money actually moves in or out of your bank account.

More specifically, revenue is recognized as income when you receive payment, and expenses are recognized when money is spent. Under accrual accounting, financial results of a business are more likely to match revenues and expenses in the same reporting period, so that the true profitability of a business can be recognized. Unless a statement of cash flow is included in the company’s financial statements, this approach does not reveal the company’s ability to generate cash. Accrual basis accounting can give you a more accurate picture of your business’s financial health because it takes your business’s unpaid expenses and your customers’ unpaid invoices into account.