Global Comparability in Financial Reporting: What, Why, How, and When? Stanford Graduate School of Business

Category : Bookkeeping

It bridges the gap between different financial reporting standards, like GAAP and IFRS. High comparability means more reliable earnings reports, while low comparability can reduce earnings significance by 25%. Ensuring semantic conciseness and interoperability in financial statements is essential for credibility. Accounting comparability is the backbone of stable markets and informed investment choices.

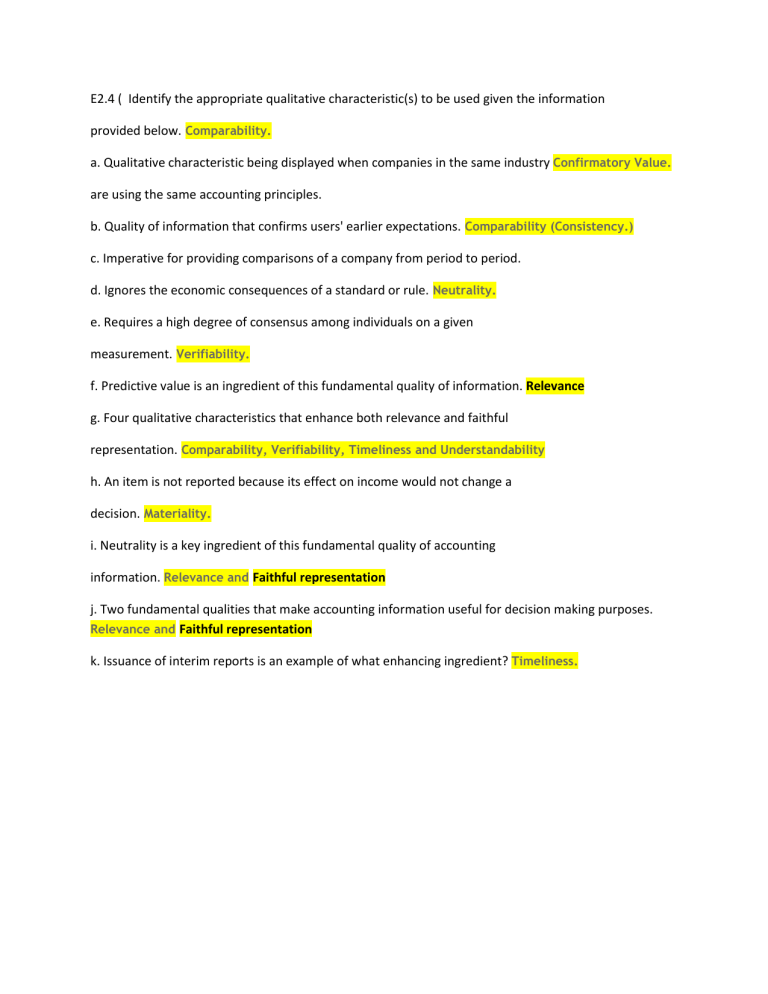

Comparability / Consistency

Without these rules and standards, publicly traded companies would likely present their financial information in a way that inflates their numbers and makes their trading performance look better than it actually was. If companies were able to pick and choose what information to disclose, it would be extremely unhelpful for investors. IFRS is a standards-based approach that is used internationally, while GAAP is a rules-based system used primarily in the U.S. IFRS is seen law firm accounting and bookkeeping 101 as a more dynamic platform that is regularly being revised in response to an ever-changing financial environment, while GAAP is more static. The Securities and Exchange Commission (SEC), the U.S. government agency responsible for protecting investors and maintaining order in the securities markets, has expressed interest in transitioning to IFRS. However, because of the differences between the two standards, the U.S. is unlikely to switch in the foreseeable future.

Internal audit quality and accounting information comparability: Evidence from China

Without the concept of comparability, financial ratios would not exist. You wouldn’t be able to compare two companies’ financial information with ratio analysis because their financial information wouldn’t be compatible. You could get a rough estimate on the worth of the company, but an accurate comparison wouldn’t exist.

Techniques for Enhancing Comparability

Theoretical debates and practical needs require in-depth research based on Chinese listed companies. Hence, compared to enterprises in less competitive industries, those in highly competitive sectors exhibit greater financial information transparency, reduced information asymmetry, and weaker agency issues. Essentially, heightened industry competition serves as an external oversight mechanism, bolstering enterprise value through enhanced financial information transparency and decreased agency problems. Since these pathways mirror the means by which internal audit elevates enterprise value, the scope for internal audit to fulfill its role is limited in the presence of robust industry competition. Consequently, the role of internal audit in enhancing enterprise value diminishes under high industry competition, whereas it strengthens in less competitive sectors. To examine the moderating impact of industry competition, we gauge industry concentration using CR4, calculated as the ratio of a company’s main business income to that of the entire industry.

2 Research on the influencing factors of accounting comparability

In the second stage, P_IAQ is utilized as the independent variable to regress model (6), and the results are presented in column (3) of Table 5. Remarkably, the coefficient of P_IAQ remains significantly positive, reinforcing the support for H1 evident in the benchmark regression results. The Conceptual Framework identifies comparability as a qualitative characteristic of useful financial reporting information. This paper explains what comparability is, why comparability is desirable, how comparability is achieved, and when we might achieve it. The paper discusses research showing that greater comparability can lower costs of comparing investment opportunities and improving financial reporting information quality. When comparability might be achieved is uncertain, although much progress has been made recently.

Accounting Principles: What They Are and How GAAP and IFRS Work

- Comparability in accounting enables stakeholders to evaluate financial information across entities and time periods.

- Fostering a culture of transparency within organizations can enhance comparability.

- The comparability concept suggests that financial reports must be prepared under the same accounting principles and methods each year.

- – Assume that company A uses the FIFO inventory method and company B uses the LIFO inventory method for valuing its inventory.

- Theoretical debates and practical needs require in-depth research based on Chinese listed companies.

- In contrast, internal audit, with its dual functions of confirmation and consultation, is better positioned to improve the quality of accounting information.

Not just in theory, but real improvements in financial stability and comparability have been seen. For example, IFRS allows inventory to be added back under some conditions, unlike GAAP. These differences affect accounting policies, touching on areas like R&D costs and investment values. IFRS also requires some research expenses to be included as assets, creating unique financial reporting characteristics. Comparability in accounting means users can consistently review financial statements. It also boosts the reliability and understanding of a company’s financial position.

Comparing these results with previous findings, it appears that while internal audit helps mitigate agency problems between management and owners, it does not address the agency issues between major shareholders and small and medium-sized shareholders. Furthermore, this demonstrates the significant control exerted by major shareholders in China. Previous studies have shown that robust internal controls, by closely monitoring managerial actions, can reduce earnings management in a company [70] and improve the quality of accounting information disclosure [1, 71]. Therefore, the mechanism for enhancing accounting information comparability through internal control closely mirrors that of internal audit. Table 3 reports the regression results of the impact of internal audit on the comparability of accounting information. Column (1) shows the regression results without any control variables, and the coefficient of CompAcct is 0.054, showing a significant positive correlation at the 1% level.

There are two main reasons why we focus on the Chinese capital market. On the one hand, as the world’s largest emerging market, China’s legal and external market supervision mechanisms are not yet sound [27]. Studying the impact of internal auditing on the comparability of accounting information at this time can help us better understand the benefits of strengthening corporate internal governance supervision mechanisms in emerging capital markets. On the other hand, the accounting information quality of Chinese listed companies varies, and the effectiveness of the capital market needs to be improved.

Since then, switching from International Accounting Standards (IAS) to IFRS has helped make financial statements more consistent. These include lower debt costs for companies and better analytical predictions. The Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) set key accounting standards.

This principle ensures that financial statements are presented in a consistent manner, following standardized accounting rules and guidelines such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). Fostering a culture of transparency within organizations can enhance comparability. Encouraging open communication and collaboration among finance teams ensures consistent accounting practices across departments and subsidiaries. Internal alignment is crucial for producing cohesive financial statements that stakeholders can trust and compare. The existing standards provide accounting chiefs with alternative choices (e.g., inventory cost-flow assumptions, depreciation methods, accounting for derivatives) and a great deal of discretion in their estimations.